The Most Important Number For Financial Health Learn Personal 16. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application.

After filing retain a copy of the forms for your records.

. Recovering Bad Debts with Credit Manager and eTR. This campaign runs from 31 December 2021 to 30 June 2022 subject to campaigns terms and conditions. Cost of Living Assistance.

If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number. There are 4 methods on how to obtain a PIN Number. MAKLUMAN PERPINDAHAN PEJABAT PENGARAH NEGERI WILAYAH PERSEKUTUAN PUTRAJAYA LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL Lembaga Hasil Dalam Negeri Malaysia.

Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. Income Tax Payment Details. Filing using a paper-based tax return.

Who is qualified for this promotion. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application. For a limited time only all approved applicants of eligible UOB credit cards will receive a guaranteed sign-up gift of RM50 Lazada E-Voucher.

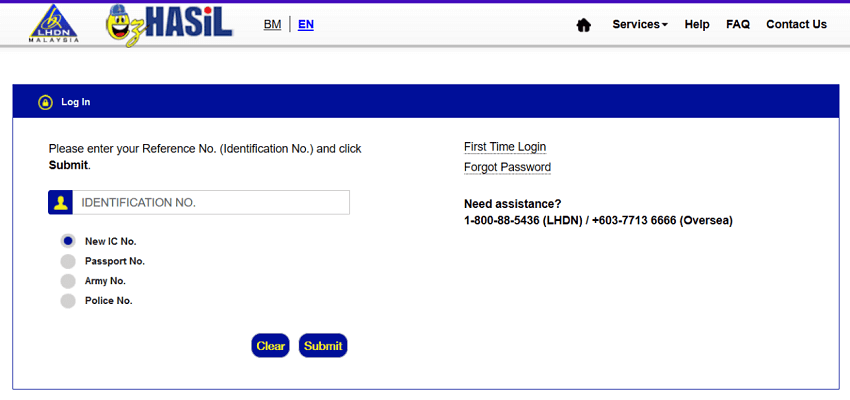

Anti-Bribery and Anti-Corruption Policy. Apply for PIN Number Login for First Time. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year.

LHDN e-Filing Guide For Clueless Employees Learn Personal 16. If you dont receive the relevant Form you may collect the form at any LHDN branch or print the softcopy of the form from LHDN website. There are 4 methods on how to obtain a PIN Number.

Taxpayers can pay direct taxes online by using the e-Payment facility. You should have received the Tax Return Form from IRB by mail 2 months before the filling deadline if you filed your Tax Return using paper-based form for prior years. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Buying a new car Learn Personal 16. Learn the Basics. If you are unsure refer to your policy document or contact your agent or the insurer directly if you bought your policy online.

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. Apply for PIN Number. In order to avail the online tax payment facility taxpayers must have a net-banking account with an authorised bank.

For employees working in Malaysia registered entities be it local or foreigner work pass holders it is a norm to see in their monthly pay slip indications of monthly contribution deducted from their monthly salary as well as their employersThis article will explain in detail what these monthly deductions entails to and why they are required by the Employment Act 1955. Apply for PIN Number. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

Apply for PIN Number Login for First Time. Provide all the necessary documents and follow the claims procedure set by. If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number.

The Permanent Account Number PAN or Tax Deduction and Collection Number TAN will have to be provided for validation as well. Customers who wish to contact LHDN may be so at the numbers provided above. Tools and FAQ guide for tax e-filing Income Tax 101 with our easy to use calculator and tax guides.

1跟LHDN申请你的所得税号码Income Tax Reference Number 登入 马来西亚内陆税收局LHDN的所得税号码申请系统 提出有关申请 填写完资料和送出申请后LHDN 会在1至3个工作日内通过电邮把你的个人所得税号码发送给你. This campaign is open to new customers only. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022.

The Inland Revenue Board of Malaysia LHDN has announced a change in its contact number for its Hasil Care Line HCL effective 16 May 2019.

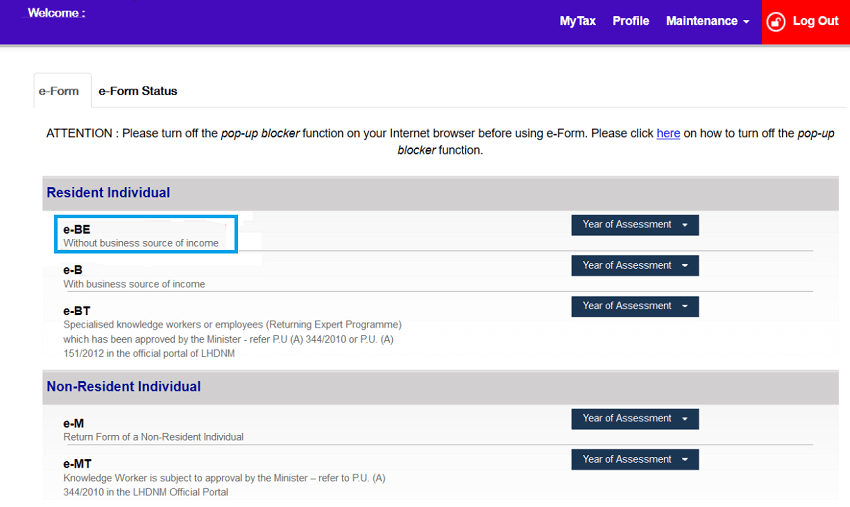

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Steps To Apply E Pin Online L Co

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Ctos Lhdn E Filing Guide For Clueless Employees

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Update Your Latest Mailing Address To Lhdn With E Kemaskini L Co

Ctos Lhdn E Filing Guide For Clueless Employees

Lhdn Login Ezhasil Kali Pertama Cara E Daftar Ehasil 2022

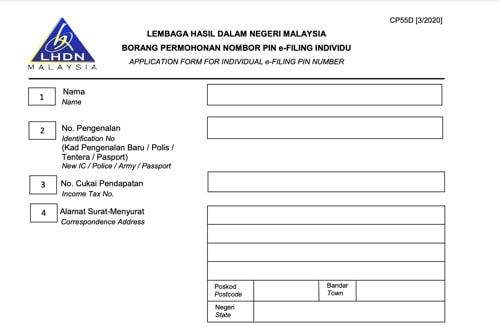

Form Cp55d Attached As Per Calcol Management Services Facebook

How To Step By Step Income Tax E Filing Guide Imoney

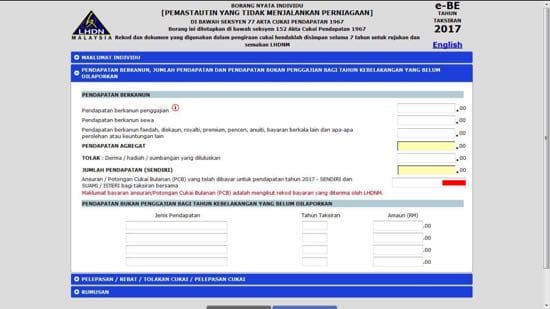

Sayangwang Cara Isi E Filing Lhdn 2017 Panduan 2018

Guide To E Filing Income Tax Malaysia Lhdn Otosection

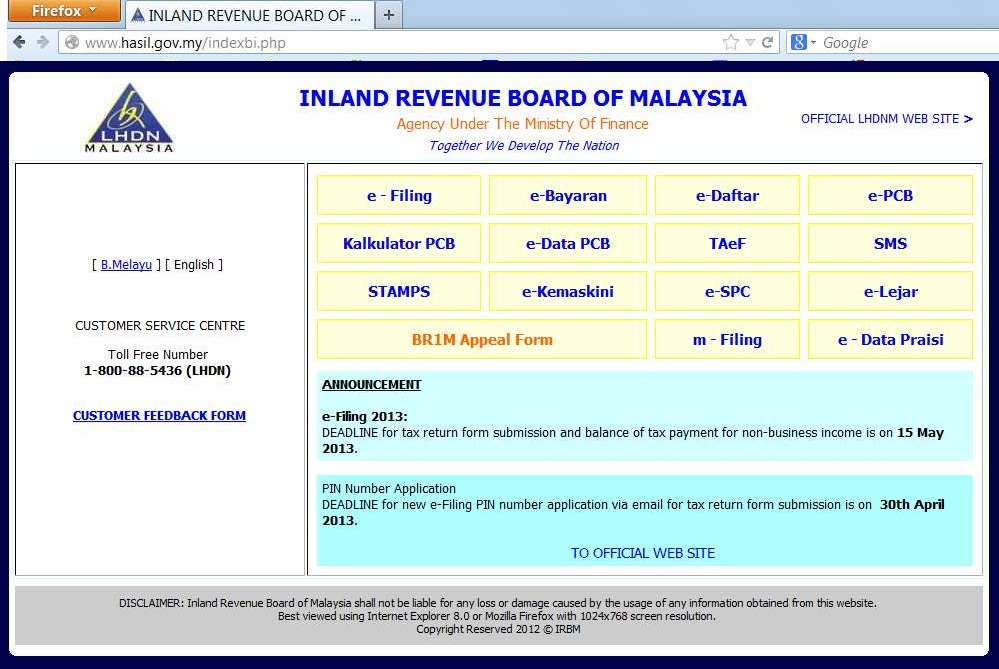

Due Day Extended For Personal Tax Submission 15 May 2013 E Filing

Ctos Lhdn E Filing Guide For Clueless Employees

Isi Cukai Pendapatan Melalui E Filing Lhdn Youtube

Ctos Lhdn E Filing Guide For Clueless Employees